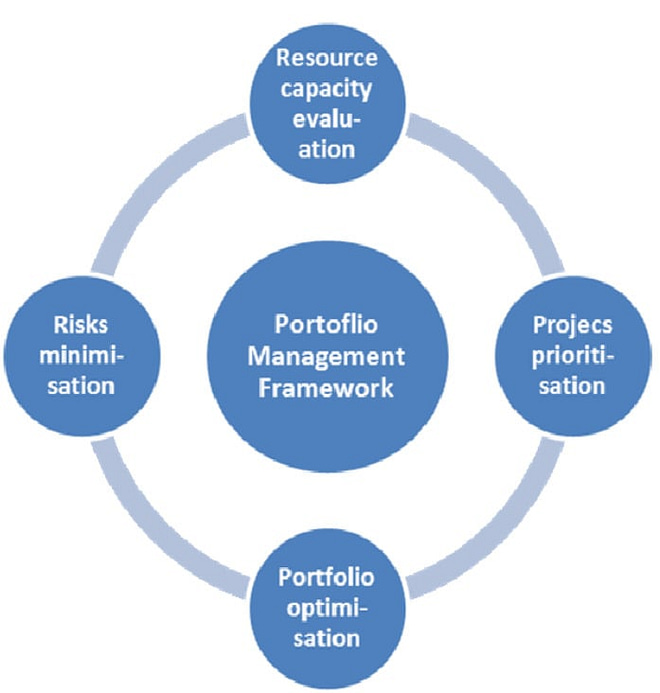

Investment portfolio management

Investment portfolio management is recognized to be the procedure of selecting and understanding a group of investments that meet the long-term financial objectives and risk tolerance of a client. It may also include a company or any organization as well. It is very important for young budding entrepreneurs to understand how and where to invest. This can be the best procedure that can guide them in an effective manner.

Some of the tools that are included within this procedure are as follows:

• Stocks

• Share

• Mutual Funds

• Bonds

• Cash

Some of the different types of Portfolio Management are enlisted herewith:

Active Portfolio Management:

From the name, it can be understood that the services provided within this kind of management are very active. The managers who are a part of this management are actively involved in buying and selling the products and they ensure that it is secure in nature. They also ensure that it can provide maximum profits to the individual.

Examples- equity mutual funds

Passive Portfolio Management:

In this kind of portfolio, it is noticed that the manager deals with a fixed type of portfolio designed from before that can match the status of the current demands. Here the fund manager’s prime duty is to replicate the performance of the benchmark indices being tracked.

Example- index mutual funds and exchange-traded funds (ETFs).

Discretionary Portfolio management services:

In this kind of service, a portfolio manager is authorized to manage the individual’s finances and investments. The individual issues money to the manager who in return takes care of his investments and also the paperwork, filing, documentation, and also his investment needs.

Non-Discretionary Portfolio Management Services:

In this kind of service, it can so be noted that the manager has no such right to advise the client on any kind of investment. It is solely the choice and decision of the client what they ought to do.

Importance

It is very important to utilize this procedure for different businessmen because of the following reasons:

• It covers a certain amount of risk through diversification and shuffling of finds among the assets according to the returns they are getting.

• It helps in proper investment and tax planning.

• It is required to undergo the proper management in any adverse conditions that one may come across in any business investment.

This gives a clear picture that Investment Portfolio Management is very important in the present situation as it helps to keep the fixed deposits secured and covers the risk through diversification as well as shuffling of funds.

If you know about Asset Allocation. Do read this topic- WHAT IS ASSET ALLOCATION? AND HOW ITS WORKS?

From Hemant K Midha