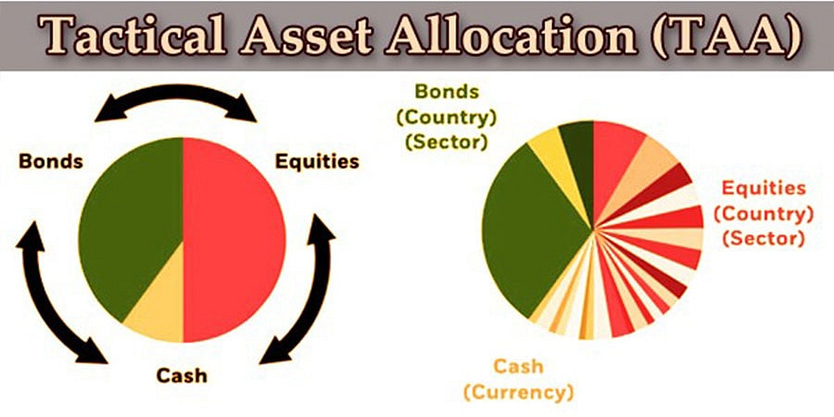

What is Tactical Asset Allocation (TAA)

Tactical Asset Allocation (TAA) is managed by the portfolio manager, He takes all the investment decisions on the individual behalf regarding buy sell or hold the asset and takes advantage of market pricing or also of the strong market sectors.

This plan of action allows assert managers to keep an eye on each and every up and down in the market and add extra value to the individual portfolio. It is an active strategy since managers are able to return to the portfolio’s asset mix once they are able to reach the desired short-term profits.

The basics

In order to understand the basic rules, the following steps are to be followed:-

The investors are supposed to have a rough idea about the strategic asset allocation.

The portfolio manager is supposed to set the investment policy statement (IPS) to set the strategic mix of assets for inclusion in the client’s holdings.

The manager is supposed to look into different factors that may be useful to affect the growth of the strategy opted. Also, the rate of return, acceptable risk levels, legal and liquidity requirements, taxes, time horizons, and unique investor circumstances are also included in this strategy.

It has a long-term percentage of asset classes which is apparently a mixture of the assets as well as the specific goals set by the investor.

The Utility of Tactical Allocation

In this process, it can be used to take active steps on strategic allocation by adjusting the long-term target weights for a short period of time. It also capitalizes on the market or the economic opportunities.

For example,

CASH = 5%

BONDS = 35%

STOCKS = 45%

COMMODITIES = 15%

This data suggest that there will be a substantial increase in demand for commodities over the next 18 months. This can also be a wise step taken by the investor to be able to shift more capital into that asset class to take the advantage of the opportunity.

Primarily tactical shifts range from 5% to 10 % which can also be lower. In different practices, it is noted that it is an unusual adjustment of any asset class to represent more than 10%. It is a different form of rebalancing a portfolio. During rebalancing, this is used to adjust the allocations made for a shorter period of time.

It can so be concluded that tactical asset allocation involves taking an active step in strategic asset allocation. It may also come within an asset class. Any TAA investor should act according to the market valuation and change it in the same market after looking into the investments.

If you know about Strategic Asset Allocation. Do read this topic- What is Strategic Asset Allocation (SAA)?

From Hemant K Midha