What is asset allocation?

It is safe to say that asset distribution is a cycle to balance return and risk By spending on forms of assets in abundance. The dynamic cycle of cost among multiple forms of assets presents a low or negative bond. It exists between different modes of Asset.

Diversification across multiple classes of assets reduces risk potential. It comes with long-term returns.

Financial planners suggest that asset allocation is vital to achieving a financial goal.

What are the different types of asset allocation in finance?

In general, there are three types of asset allocation.

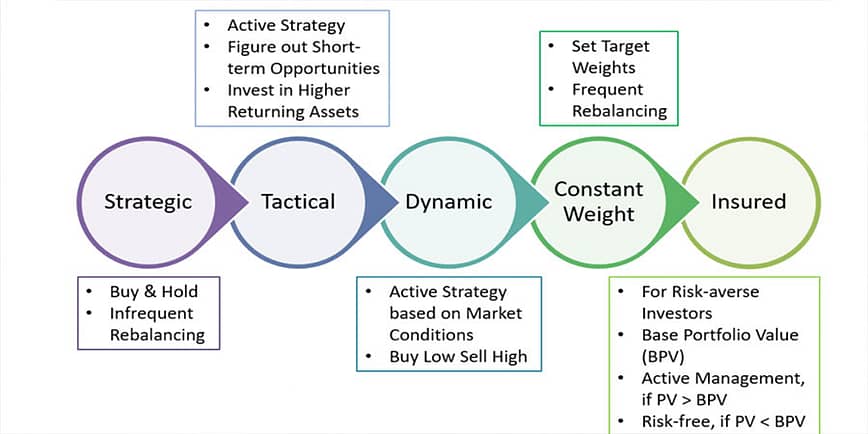

• Strategic asset allocation

• tactical asset allocation

• dynamic asset allocation

1. Strategic asset allocation?

As far as this concept of allocation goes, the fund comes with a static allocation mix.

The static allocation mix for Mutual Funds lies wherein the scope.

Due to changes in the price of different assets, the actual mix will diverge from the expected means from time to time.

It gives the fund manager a sense of freedom.

It keeps the value between 0.65 to 0.75 of the equity.

It has 0.25 of the debt.

The funds’ mandate establishes what the ideal allocation mix will be. Nevertheless, rebalancing is needed to Keep the mandated asset mix as expected.

Strategic asset allocation plays a vital role in the cycle of buying stock and bonds.

Keep in mind that static asset allocation is a cycle with long-term benefits. We feel is that you should stick to your asset allocation strategy irrespective of the price movements. It prevents you from making wrong investment choices out of greed and fear.

2. Tactical asset allocation

One of the backlogs of strategic asset allocation is that it is too rigid. Due to changes in market conditions, there might be extra returns That strategic asset allocation would not Be able to capitalize on.

Tactical asset allocation calls in for market conditions Needs sufficient expertise investment. Momentum-based strategy is an instance of tactical asset allocation.

3. Dynamic asset allocation

In terms of the asset allocation plan, you keep on adjusting the allocation mix based on the market conditions. Contra strategy or counter-cylindrical plan is the most favorite dynamic asset allocation plan. Some dynamic asset allocation plan follows a pro-cyclical plan. It helps to increase the equity allocation in a dynamic market. Some dynamic asset allocation approach combines what they call tactical and core plans.

The core portfolio follows a countercyclical and momentum-based plan.

If you know Tactical Asset Allocation (TAA). Do read – Tactical Asset Allocation (TAA)

From Hemant K Midha