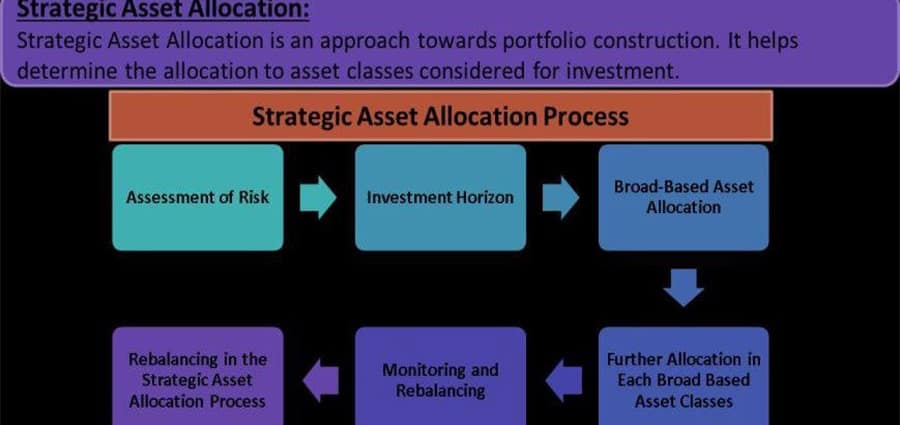

Strategic Asset Allocation (SAA)

Strategic Asset Allocation (SAA), is a portfolio strategy in which the investor is able to set a target allocated for various asset classes and rebalances the portfolio periodically. The target allocations are based on different such as investor’s risk tolerance, count horizon, and investment objectives.

• It is important for creating and balancing the investment portfolio.

• It is one of the main factors that can help varied businessmen to get overall returns.

• It is helpful to establish an appropriate asset mix of stocks, bonds, cash, and real estate in the portfolios and gives a different dimension.

• The asset allocation should thus be able to reflect the goals at any point within a specific period of time.

A Contrarian Approach

Interestingly, there is a contrarian approach to investing. When any asset class performs well relative to other asset classes, the SAA strategy would be able to sell positions in that asset class and distribute them to the poorer performing asset classes.

In this, the investors go against the prevailing market trends by selling when others are buying more but most investors are selling.

Factors Affecting Strategic Allocation

1. Risk Tolerance

Investors with a high-risk tolerance are able to accept higher volatility. Therefore, they are likely to put a greater asset class on stocks and a lower asset class mass on bonds and cash. Investors with a low-risk tolerance would likely place an asset class weight on stocks and a higher asset class load on binds and cash.

2. Investment Horizon

Investors who are planning to have a long-term investment horizon would likely invest in higher riskier asset classes. The prime reason is that due to having a longer investment horizon, the investor is able to understand the situation. Also, in terms of the poor market conditions, they are also able to liquidate their assets and meet their retirement or cash needs.

3. Return Objectives

The desired returns from an investor are important as it affects the strategic assets and their allocation weights. It exerts a significant effect on the strategic allocation weight. A higher return requires a higher asset allocation as well as the specific class to achieve the desired returns.

It can so be concluded that this procedure, involves choosing a proper asset class. It requires proper allocations and rebalancing periodically to match the asset class allocations. It includes risk tolerance, time horizon, and return objectives.

If you know about one of the best hybrid fund in the market. Do read this topic- ICICI BALANCED ADVANTAGE FUND

From Hemant K Midha