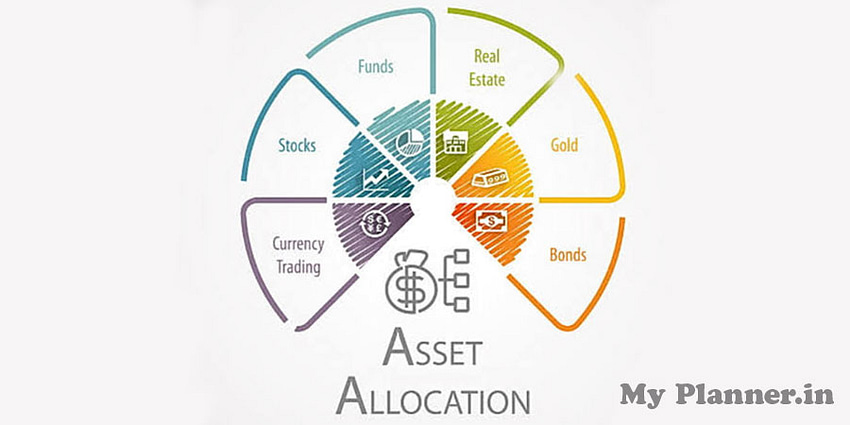

Asset allocation

Asset allocation is part of an investment plan that aims to balance risk and reward by dividing the investment portfolio among other types of assets.

It includes fixed income, cash equivalents, cash, equity, and more. Studies show that asset allocation helps an investor reduce the impact of risk on their portfolio.

What is the value of asset allocation?

A different class of assets moves in different directions. All types of assets hardly perform in tandem. One might assume that it’s better to invest in mutual funds because it performs well at some point. But, it is hard for an individual to predict which asset would move in which direction.

For instance, it is hard to assume when equities will rise and gold investment will climb down. So, it makes sense to allocate investments in multiple classes of assets. It gets done so that if one set of asset classes underperforms, the other set will balance the underperformance.

Investing your portfolio in one set of mutual fund plans is highly risky.

If your wealth gets split among multiple classes, it tends to do better.

What are the classes of assets available there?

In general, there are three types of asset classes. But, financial experts argue that there are four broad categories of investments such as equity, cash, real estate, and fixed income. Two types of assets are as follows.

Fixed income:

It is one of the oldest and most popular classes of investment options like market instruments, government, corporate bonds, debt securities, and more.

Cash and cash equivalent:

It’s likewise known as money-market instruments. It’s best suited for short-term investment goals. Liquidity is one of the benefits of such assets.

How does asset allocation work?

We will understand the asset allocation cycle with the help of an example. For instance, a store sells winter apparel like gloves, boots, jackets, and scarves. It likewise sells gears like skies and ice skates. It experiences huge sales in the months of winter. But, the store tends to underperform in the months of summer.

The store wishes to expand its product line. It opens a section that sells clothes for the summer season too.

The store makes a sale in both winter and summer. Next, the store merges with a departmental store to sell all sorts of products. It is worth noting that there is no fixed way to invest.

If you know about the registration of a will. Do read COST OF REGISTRATION OF A WILL IN INDIA

From Hemant K Midha